2 Money Market Funds Paying Above 5%

Money market funds are fixed-income mutual funds that invest in debt securities with short maturities and very low credit risk. They provide short-term liquidity with a

Money market funds are fixed-income mutual funds that invest in debt securities with short maturities and very low credit risk. They provide short-term liquidity with a

Banks are cyclical stocks that perform well when the economy is strong and less well when the economy is in recession. These days, the global

Markets are contending with inflation rates at 40-year highs, Russia’s invasion of Ukraine, supply chain kinks and food shortages, rising interest rates, widespread predictions of

Technology stocks ended 2023 with a bang, powered by a combination of factors. This rally in tech was unexpected considering that investors spent most of

Whether you’re looking for reliable sources of passive income or new capital to re-invest, dividend investing can be a vital strategy that helps you

Buffett’s investment strategy is based on: Buffett invests from a long-term perspective. If he can’t see himself as a shareholder for years, he won’t

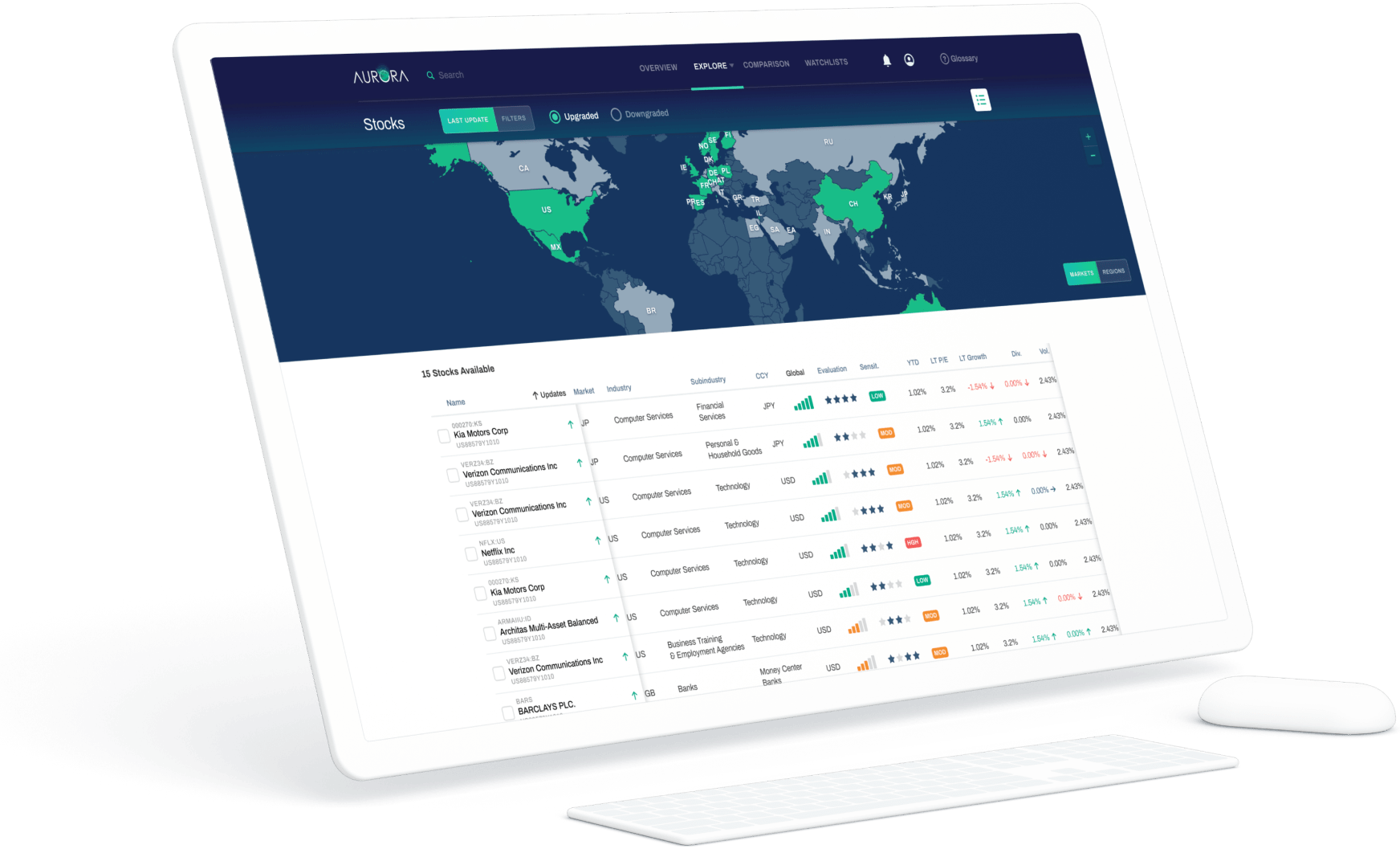

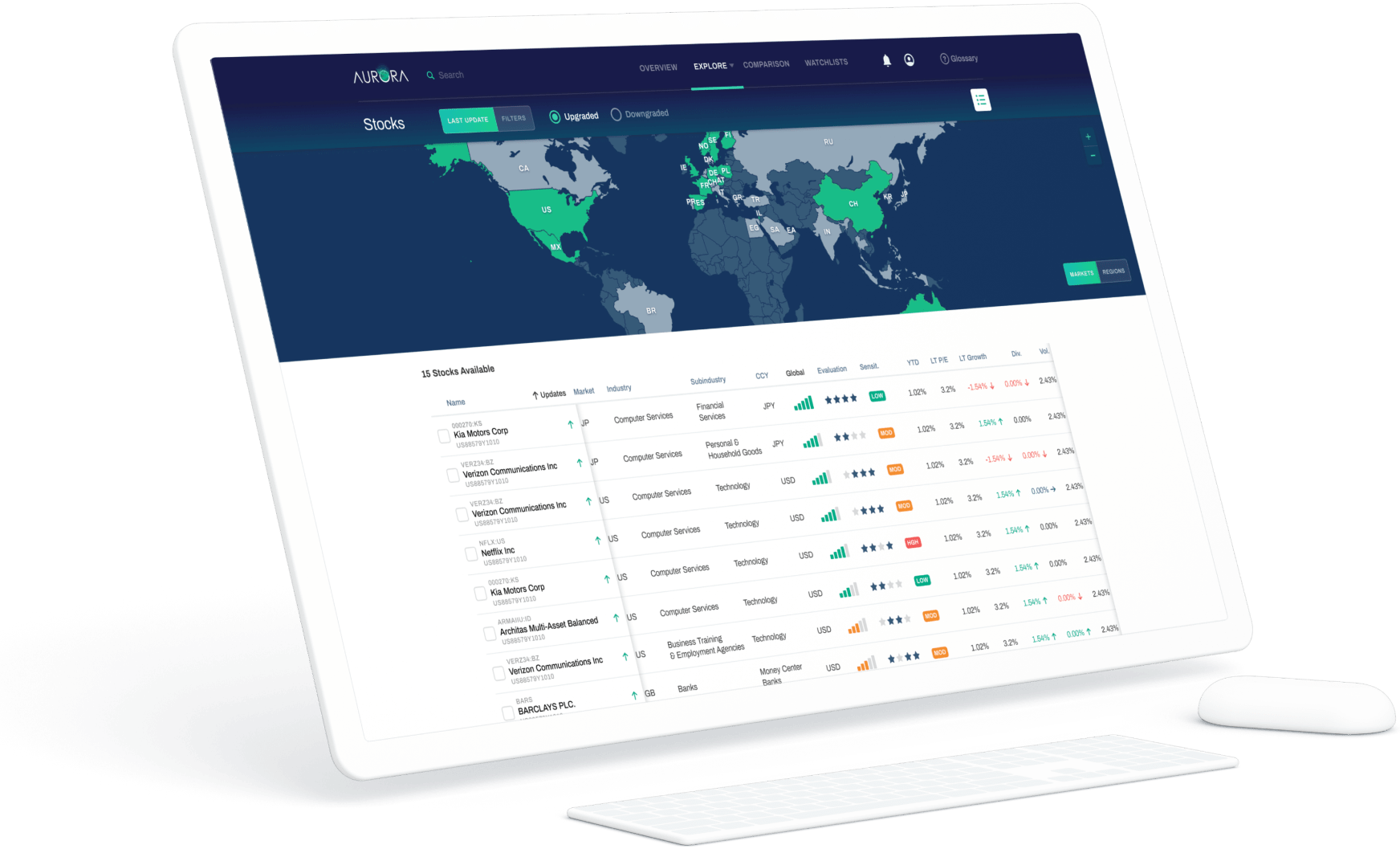

AURORA is the Swiss system that supports Investors with data, research, and portfolio diagnostics for stocks, funds, and investment portfolios worldwide. Used by the world’s

Finding value stocks is one of the best ways to outperform the market over the long term. It’s an approach involving buying stock in solid

Disclaimer

The system provides information and financial data to help you identify investment ideas. However, we do not advise or guide you in this regard, or provide recommendations on what products to buy or sell – these decisions are yours alone. SDIS and the system are not subject to regulation, and SDIS does not hold a license for investment advice, investment marketing or management of investment portfolios under any law.

The content provided in the system is independent and is not based on or tailored to your personal circumstances, needs or purposes, and should not be relied upon as an assessment of the profitability or suitability of investing in a particular stock for any purpose. Past performance is no guarantee of present or future performance. Investments can lose their full value.

This website uses cookies to collect statistics about our visitors and to help us analyze how the site is used. Please see our privacy policy. By clicking "I agree" you agree to our use of cookies and similar technologies.