Finding value stocks is one of the best ways to outperform the market over the long term. It’s an approach involving buying stock in solid companies that are lower priced relative to their earnings and long-term growth. When the market eventually discovers the company’s undervalued, the returns can exceed the market.

BRITVIC (LSE: BVIC) (857)

Britvic plc, together with its subsidiaries, manufactures, markets, distributes, and sells soft drinks in the United Kingdom, the Republic of Ireland, France, Brazil, and internationally. It provides fruit juices, syrups, squash, mineral water, sodas, mixers, and energy and flavored drinks. Britvic plc was founded in 1930 and is based in Hemel Hempstead, the United Kingdom.

Analysis

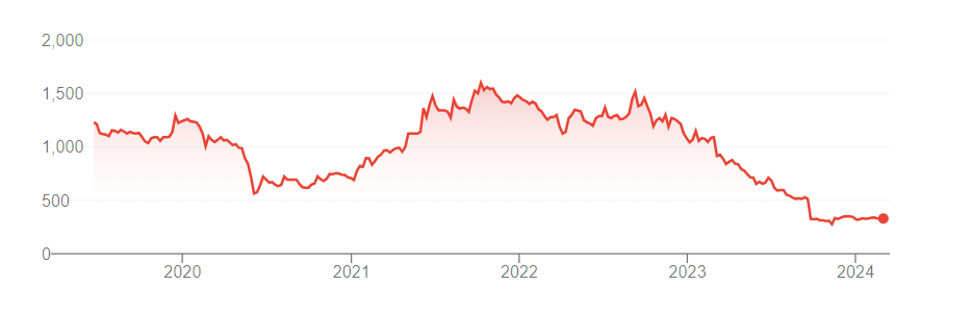

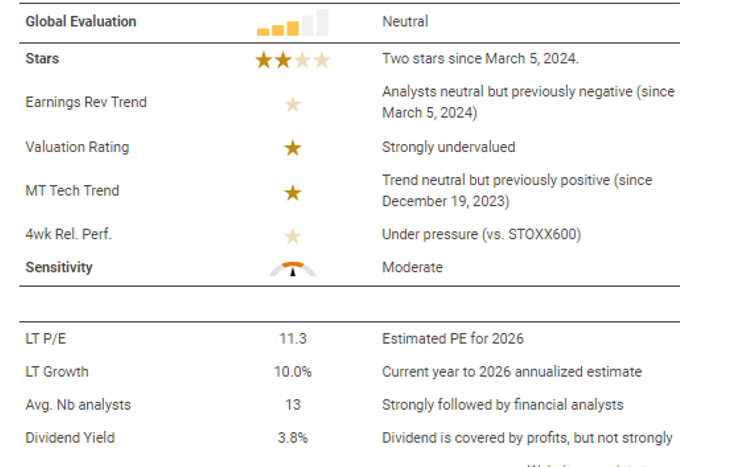

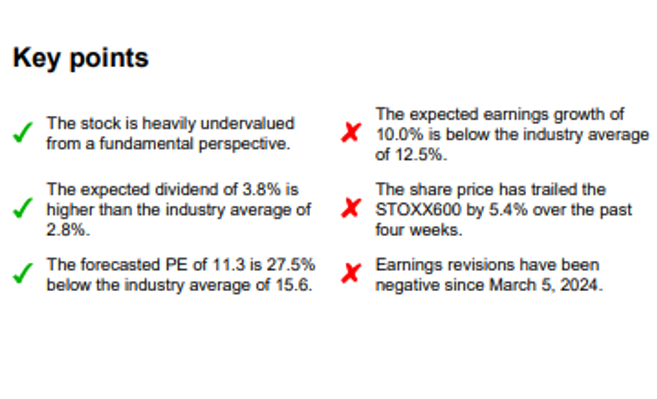

The stock currently meets two of our four stars. It has fundamentally attractive price potential and a stable 40-day price trend. However, it has failed to outperform the STOXX600 index and has also failed to receive analyst support recently. The situation in the sector environment is similar, with also two star criteria met. In the past, the share price has reacted to stressful situations with typical market price losses.

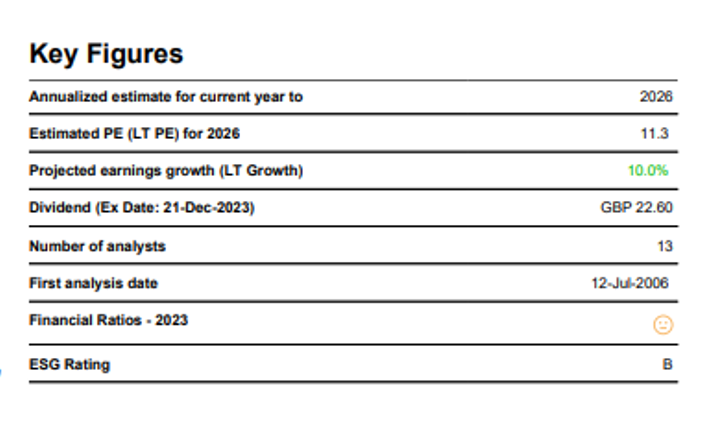

BRITVIC appears fundamentally very undervalued compared to its theoretical fair price. its valuation is more attractive than the European Food & Beverage aggregate. The fundamental price potential for BRITVIC looks good, and better than the average of its industry group. The forecasted PE of 11.3 is 27.5% below the industry average of 15.6. The G/PE ratio 1.2 indicates that the stock’s price presents a discount to growth.

BRITVIC is strongly followed by financial analysts, as over the last three months an average of 13 analysts provided earnings estimate forecasts up until the year 2026. The expected earnings growth of 10.0% is below the industry average of 12.5%. Currently, these analysts are slightly raising their earnings growth estimates by 0.5%; nevertheless, the trend remains unfavorable because the last significant trend is negative. This negative pressure on the growth expectations has been continuous over the past 12 months.

The expected dividend of 3.8% is higher than the industry average of 2.8%.

MARKS & SPENCER (LSE: MKS) (250.8)

Marks and Spencer Group plc operates various retail stores. It operates through five segments: UK Clothing & Home, UK Food, International, Ocado, and All Other. The company was founded in 1884 and is headquartered in London, the United Kingdom.

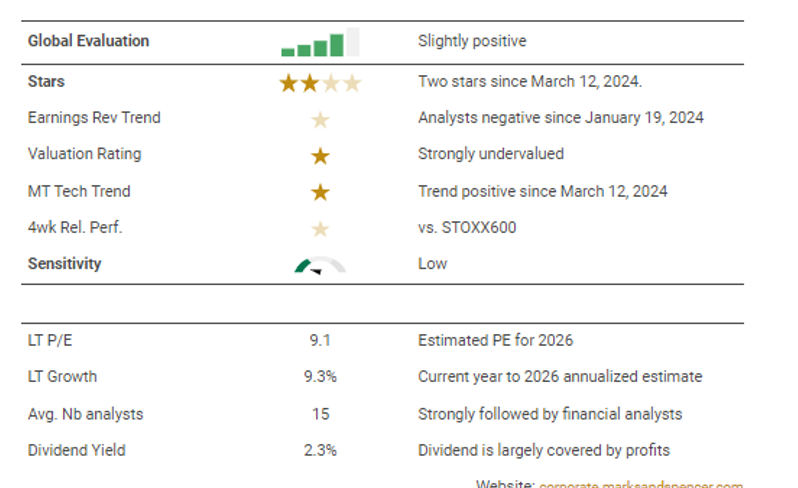

Analysis

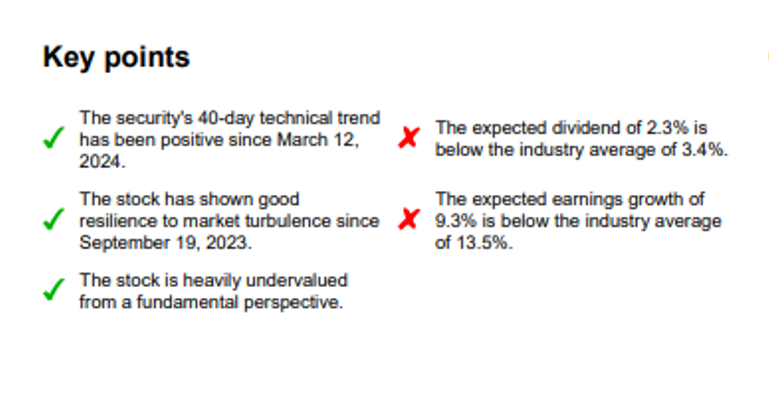

The stock currently meets two of our four stars. It has fundamentally attractive price potential and a positive 40-day price trend. However, it has failed to outperform the STOXX600 index, nor has it received any new analyst support. The situation in the sector environment is similar, with also two star criteria met.

In the past, the share price has reacted to stress signals with below-average price losses. We view this defensive behaviour as positive. This is an important valuation criterion, equivalent to the star rating. Taking into account this defensive sensitivity to losses, we obtain an overall positive impression.

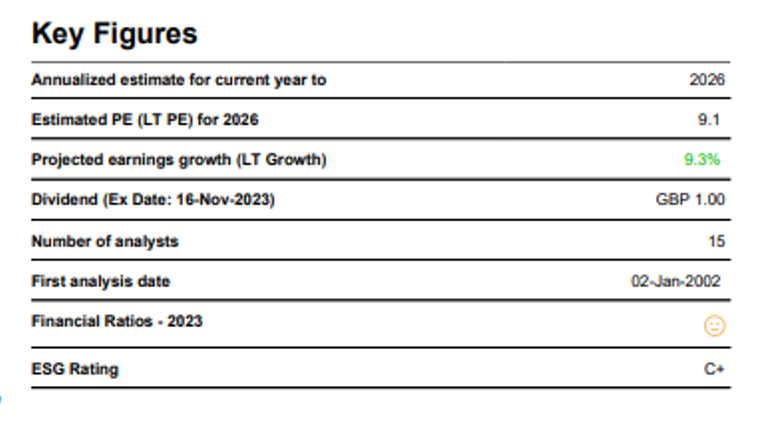

MARKS & SPENCER appears fundamentally very undervalued compared to its theoretical fair price.its valuation is comparable to the European Retail aggregate. The fundamental price potential for MARKS & SPENCER looks good, and in line with the average of its industry group. The forecasted PE of 9.1 is 33.9% below the industry average of 13.7. The G/PE ratio of 1.3 indicates that the stock’s price presents a discount to growth.

MARKS & SPENCER is strongly followed by financial analysts, as over the last three months an average of 15 analysts provided earnings estimate forecasts up until the year 2026. The expected earnings growth of 9.3% is below the industry average of 13.5%. Currently, these analysts are negatively revising their earnings growth estimates by -1.8% compared with seven weeks ago. This negative pressure on the growth expectations has been apparent since January 19, 2024.

The expected dividend of 2.3% is below the industry average of 3.4%.

GLAXOSMITHKLINE (LSE: GSK) (1685.2)

GSK plc, together with its subsidiaries, engages in the research, development, and manufacture of vaccines, and specialty and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally. It operates through two segments, Commercial Operations and Total R&D. The company offers shingles, meningitis, respiratory syncytial virus, flu, polio, influenza, and pandemic vaccines. It also provides medicines for HIV, oncology, respiratory/immunology, and other specialty medicine products, as well as inhaled medicines for asthma and chronic obstructive pulmonary disease, and antibiotics for infections. GSK plc was founded in 1715 and is headquartered in Brentford, the United Kingdom.

Analysis

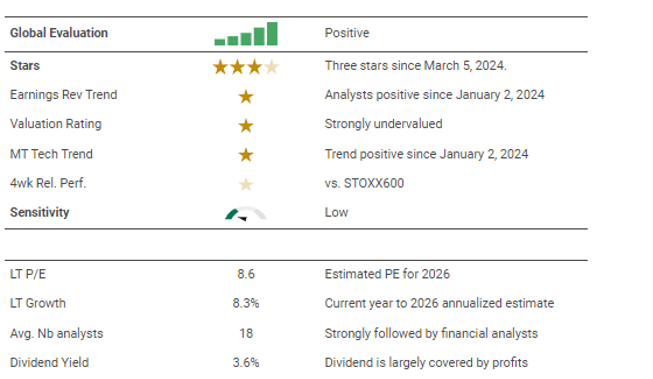

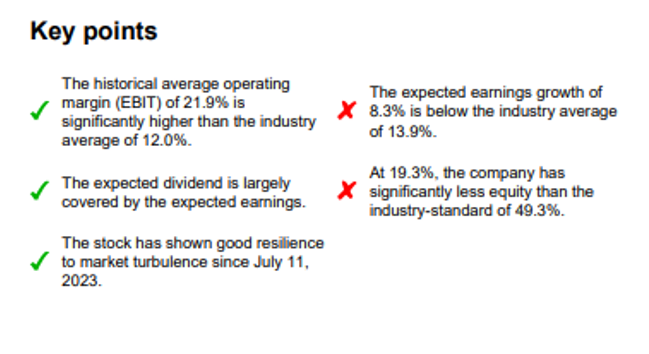

The stock currently meets three of our four stars. From a fundamental point of view, the share price is attractive and the future prospects are intact according to analysts. Market signals in this case are mixed: the share price has recently been trending upwards, but has not always been able to follow the STOXX600

index over the past four weeks. The situation in the sectoral environment is even slightly more favourable, with four star criteria met. In the past, the share price has reacted to stress signals with below-average

price losses. We view this defensive behaviour as positive. This is an important valuation criterion, equivalent to the star rating. Taking into account this defensivesensitivity to losses, we obtain a positive overall impression.

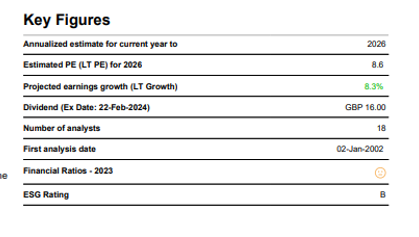

GLAXOSMITHKLINE appears fundamentally very undervalued compared to its theoretical fair price.its valuation is more attractive than the European Health Care aggregate. The fundamental price potential for GLAXOSMITHKLINE looks good, and better than the average of its industry group. The estimated PE 8.6 is for the year 2026. The G/PE atio 1.4 indicates that the stock’s price presents a discount to growth.

GLAXOSMITHKLINE is strongly followed by financial analysts, as over the last three months an average of 18 analysts provided earnings estimate forecasts up until the year 2026. The expected earnings growth of 8.3% is below the industry average of 13.9%. Currently, these analysts are positively revising their earnings growth estimates by 4.7% compared with seven weeks ago. This positive pressure on the growth

expectations has been apparent since January 2, 2024.

The 12-month indicated dividend yield is 3.6%. This estimated dividend represents 0.7% of the estimated earnings. Consequently, the dividend is easily covered, and very likely to prove sustainable.

Disclaimer

The system provides financial information and data to help you identify investment ideas. However, we do not advise you or guide you about this or what products to purchase or sell – these decisions are yours only. SDIS and the system are not subject to regulation, and SDIS does not hold a license for investment advisory, investment marketing, or investment portfolio management under any law. The content provided on the system is independent and not based or tailored to your circumstances, To your needs, or your purposes, and should not be relied on as an estimate of profitability or the suitability of an investment in a particular stock for any purpose. Past performance is not a guarantee of present or future performance. Investments may lose their full value.