Money market funds are fixed-income mutual funds that invest in debt securities with short maturities and very low credit risk. They provide short-term liquidity with a potential market return higher than bank deposits. Now that interest rates are rising, seven-day yields have climbed. Still, inflation remains high. Rising interest rates are enabling savers to trim the gap between the value of their savings in money market funds and the pace at which inflation is eroding that money’s purchasing power.

abrdn Liquidity Fund (Lux) – Sterling Fund A-2 Acc GBP

Abrdn Liquidity Fund (Lux) – Sterling Fund A-2 Acc GBP is a Short Term fund in the

Money Market asset class, investing in the United Kingdom geographic zone. abrdn

Investments Luxembourg S.A. is its promoter. The fund currently has US$ 17.76 bn under management making it a large capfund. Over the last twelve months,this fund has reached a high of GBP 5,150.84 and a

low of GBP 4,905.75. Its current price of GBP 5,150.84 places it close to its highest

price and 5.0% above its lowest price (weekly closing).

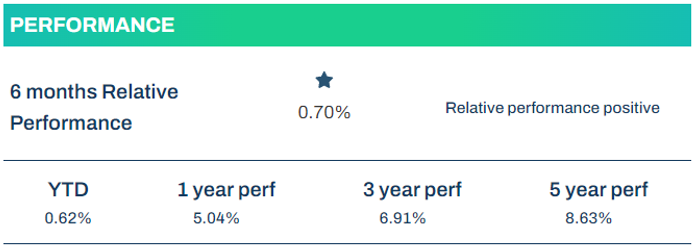

As of February 20, 2024, the general impression that emerges from the fundamental and

technical elements (information ratio, Sharpe ratio, technical factors) is positive.

On the other hand, the combined sensitivity factors (volatility, correlation coefficient, Beta, Bear

Market Factor and Bad News Factor) lead to a general fund qualification of low sensitive.

By combining the positive fundamental and technical analysis, with the low sensitivity,

the general evaluation seems slightly positive.

Summary: Fundamental and Technical Analysis

- This fund rewards well for taking relative risk.

- No reward for volatility.

- The 40 day technical trend up in a bullish environment.

- In the past 6 months, the fund has experienced over-performance in a negative environment

(Money Market-All (EP)).

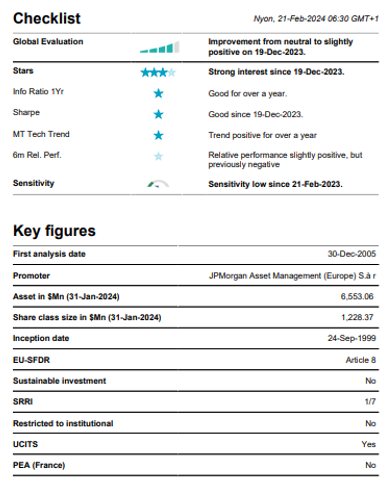

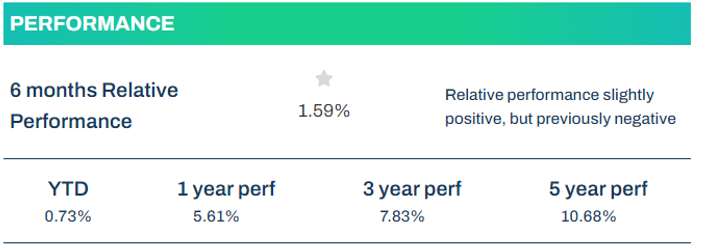

JPMorgan Liquidity Funds – USD Standard Money Market VNAV Fund C

JPMorgan Liquidity Funds – USD Standard Money Market VNAV Fund C (acc.) is

a Short Term fund in the Money Market asset class, investing in the United States

of America geographic zone. JPMorgan Asset Management (Europe) S.à r is its

promoter. The fund currently has US$ 6.55 bn under management making it a large cap fund.

Over the last twelve months,this fund has reached a high of USD 15,909.28 and

a low of USD 15,077.49. Its current price of USD 15,909.28 places it close to its

highest price and 5.5% above its lowest price (weekly closing).

As of February 20, 2024, the general impression that emerges from the fundamental and

technical elements (information ratio, Sharpe ratio, technical factors) is positive.

On the other hand, the combined sensitivity factors (volatility, correlation coefficient, Beta, Bear

Market Factor and Bad News Factor) lead to a general fund qualification of low sensitive.

By combining the positive fundamental and technical analysis, with the low sensitivity,

the general evaluation seems slightly positive.

Summary: Fundamental and Technical Analysis

- This fund rewards well for taking relative risk.

- Volatility is well rewarded.

- The 40 day technical trend up in a bullish environment.

- In the past 6 months, the fund has experienced over-performance in a negative environment

(Money Market-All (US)).