Many analysts beleive that the semiconductor industry, which experienced a slowdown throughout 2022 and 2023, will return to growth in 2024. The slowdown was due to the cyclical nature of the industry, combined with supply chain disruptions, component shortages, the global economic downturn and geopolitical turmoil. The projected high growth in 2024 is due to strong demand from endpoint device manufacturers and AI servers.

MICRON TECHNOLOGY (NASDAQ: MU) (86.48)

Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. It provides memory and storage technologies comprising dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; non-volatile and re-writeable semiconductor storage devices; and non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels. The company offers memory products for the cloud server, enterprise, client, graphics, networking, industrial, and automotive markets, as well as for smartphone and other mobile-device markets; SSDs and component-level solutions for the enterprise and cloud, client, and consumer storage markets; discrete storage products in component and wafers; and memory and storage products for the automotive, industrial, and consumer markets. It markets its products through its direct sales force, independent sales representatives, distributors, retailers; and web-based customer direct sales channel, as well as through channel and distribution partners. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho.

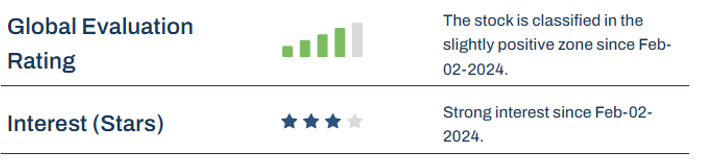

The stock currently meets three of our four stars. From a fundamental point of view, the share price is attractive and the future prospects are intact according to analysts. Market signals in this case are mixed: the share price has recently been trending upwards, but has not always been able to follow the SP500 index over the past four weeks. The situation in the sectoral environment is even slightly more favourable, with four star criteria met. In the past, the share price has reacted to stressful situations with typical market price losses. Loss sensitivity is an important valuation criterion for us, just like the

star rating. Taking into account this average loss sensitivity, we obtain an overall positive impression.

MICRON TECHNOLOGY appears fundamentally undervalued compared to its theoretical fair price. Its valuation is comparable to the American Technology aggregate. The fundamental price potential for MICRON TECHNOLOGY looks good, and in line with the average of its industry group. Note that the projected earnings growth to the estimated PE ratio of 33.43 is very high, indicating a potentially out of the norm situation, like an extraordinary decline in earnings followed by rebound expectations.

MICRON TECHNOLOGY is strongly followed by financial analysts, as over the last three months an average of 24 analysts provided earnings estimate forecasts up until the year 2025. The annualized growth estimate is 26.7% for the current year to 2025. Currently, these analysts are positively revising their earnings growth estimates by 17.4% compared with seven weeks ago. This positive pressure on the growth expectations has been apparent since December 1, 2023. confirms the positive technical trend.

The 12-month indicated dividend yield is 0.5%. This estimated dividend represents

6.0% of the estimated earnings. Consequently, the dividend is easily covered, and very

likely to prove sustainable.

ALPHAWAVE IP GROUP (LSE: AWE) (130.8)

Alphawave IP Group plc designs, develops, and sells connectivity solutions. The company offers connectivity, integrated products, and chiplet IP products. It serves the data center, artificial intelligence, 5G wireless infrastructure, data networking, autonomous vehicles, and solid-state storage end markets in North America, the Asia Pacific, Europe, and the United Kingdom. Alphawave IP Group plc was founded in 2017 and is headquartered in London, the United Kingdom.

The stock currently meets three of our four stars. Positive market signals in absolute and relative terms are balanced by negative analyst signals. Fundamental analysis shows price potential intact.

The situation in the sectoral environment is even slightly more favourable, with four star criteria met.

In the past, the share price has reacted to stressful situations with typical market price losses. Loss sensitivity is an important valuation criterion for us, just like the star rating. Taking into account this average loss sensitivity, we obtain an overall positive impression.

ALPHAWAVE IP GROUP appears fundamentally undervalued compared to its theoretical fair price. Its valuation is less attractive than the European Technology aggregate. The fundamental price potential for ALPHAWAVE IP GROUP looks good. Note that the projected earnings growth to the estimated PE ratio of 1.67 is very high, indicating a potentially out of the norm situation, like an extraordinary decline in

earnings followed by rebound expectations.

ALPHAWAVE IP GROUP is weakly followed by financial analysts, as over the last three months an average of 4 analysts provided earnings estimate forecasts up until the year 2025. The annualized growth estimate is 26.7% for the current year to 2025. Currently, these analysts are negatively revising their earnings growth estimates by -16.1% compared with seven weeks ago. This negative pressure

According to estimates, no dividend is foreseen in the next 12 months.