NVIDIA active in the sector Semiconductors, belongs to the industry group

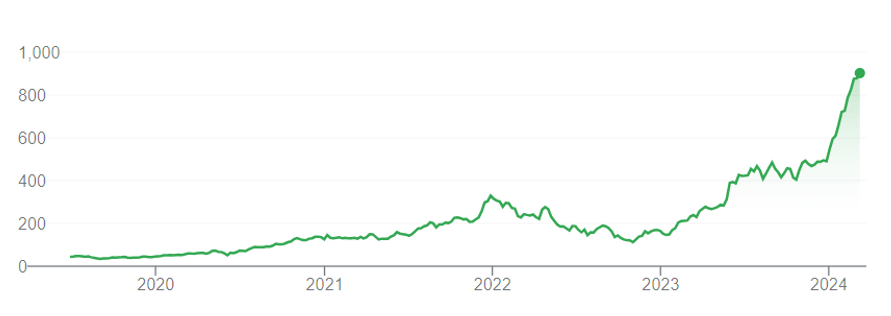

Technology. Its market capitalization of USD 2,211.37 bn. ranks it among large-cap stocks and3 in the world, in its group. During the last 12 months this stock has reached a high of USD 919.13 and a low of

USD 257.25; its current price of USD 893.98 places it 2.7% under its 52 week high and 247.5% over its 52 week low. Performance since March 17, 2023: NVIDIA: 247.5%, Technology: 48.2%, SP500: 32.2%.

Analysis 19/3/2024

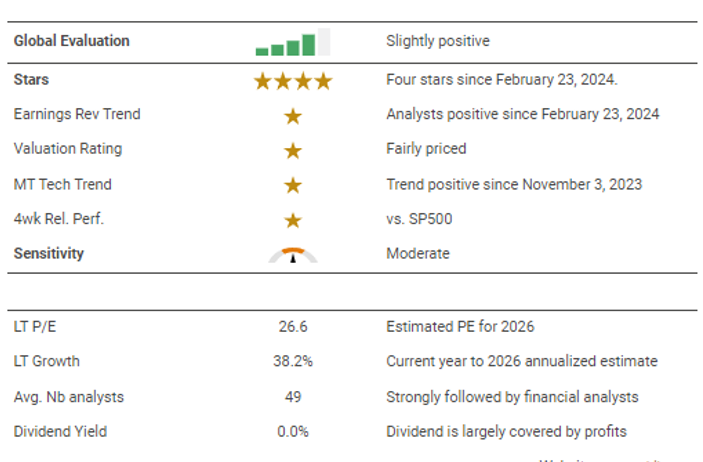

The stock meets all our stars. The market, analysts and fundamental analysis have shown positive signals. NVIDIA was considered attractive by the market and also moved positively against the SP500 index. The stock remains fundamentally cheap and analysts were optimistic in revising earnings forecasts upwards.

This pleasing situation is not specific to the company, but is also reflected in the sectoral environment in general. In the past, the share price has reacted to stressful situations with typical market price losses. Loss sensitivity is an important valuation criterion for us, just like the star rating. Taking into account this average loss sensitivity, we obtain an overall positive impression.

Valuation

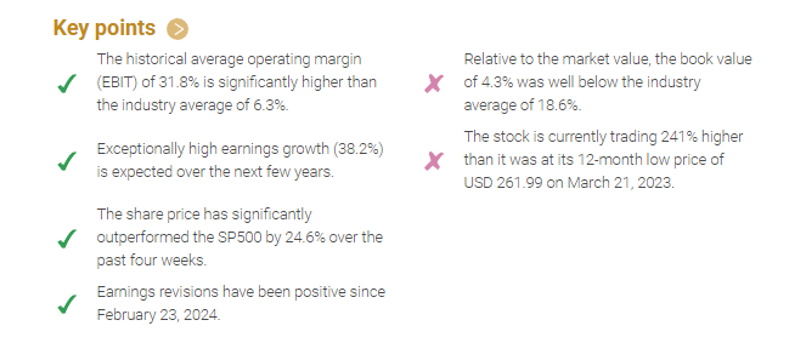

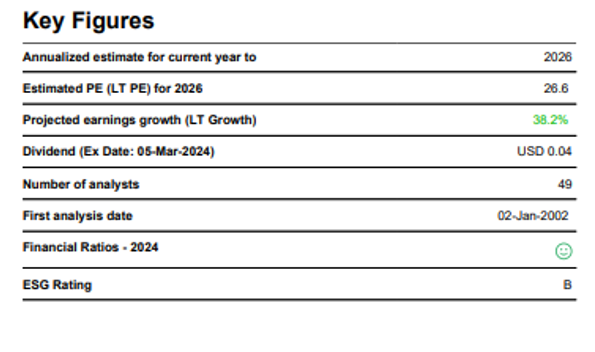

NVIDIA appears fundamentally fairly valued compared to its theoretical fair price.its valuation is less attractive than the American Technology aggregate. The fundamental price potential for NVIDIA looks reasonable. The estimated PE is 26.6 for the year 2026. The G/PE ratio 1.4 indicates that the stock’s price presents a discount to growth.

Earnings

NVIDIA is strongly followed by financial analysts, as over the last three months an average of 49 analysts provided earnings estimate forecasts up until the year 2026. Exceptionally high earnings growth (38.2%) is expected over the next few years. Currently, these analysts are positively revising their earnings growth estimates by 38.6% compared with seven weeks ago. This positive pressure on the growth expectations has been apparent since February 23, 2024. The historical average operating margin (EBIT) of 31.8% is significantly higher than the industry average of 6.3%.

Disclaimer

The system provides information and financial data to help you identify investment ideas. However, we do not advise or guide you in this regard, or provide recommendations on what products to buy or sell – these decisions are yours alone. SDIS and the system are not subject to regulation, and SDIS does not hold a license for investment advice, investment marketing or management of investment portfolios under any law.

The content provided in the system is independent and is not based on or tailored to your personal circumstances, needs or purposes, and should not be relied upon as an assessment of the profitability or suitability of investing in a particular stock for any purpose. Past performance is no guarantee of present or future performance. Investments can lose their full value.