DIAGNOSE YOUR PORTFOLIO

A short guide which includes:

• The process of setting up and managing your Portfolios and Watchlists at Aurora DIY Investing.

• How to run a Portfolio Diagnostic.

• Managing your notifications and Alerts

(4 mins)

DIAGNOSE YOUR INVESTMENT PORTFOLIO

Diagnose your Investment Portfolio with Aurora DIY Investing today!

When it comes to DIY Investing, finding the right tool to mon-itor your holdings is crucial. Whether you simply want to keep an eye on performance, track risk or get an in-depth understanding of your portfolio composition as part of a re-balancing exercise, Aurora gives you everything you need to track your investments, providing you with detailed updates twice a week.

And it couldn’t be easier!

Our diagnostic reports include:

- Allocations by Asset class and currency

- Portfolio quality analysis for equities and funds

- 7-day portfolio performance analysis

- Updates since the last report

- Quality Analysis of each holding

- Allocation by sector and region

- Identified ‘weak’ holdings

- A list of potential alternative

In this short guide, we show you how in 4 simple steps:

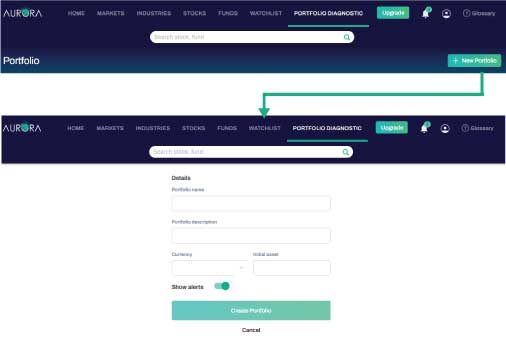

1. Log in to the site, click ’Portfolio Diagnostic’ and the ‘+ New Portfolio’.

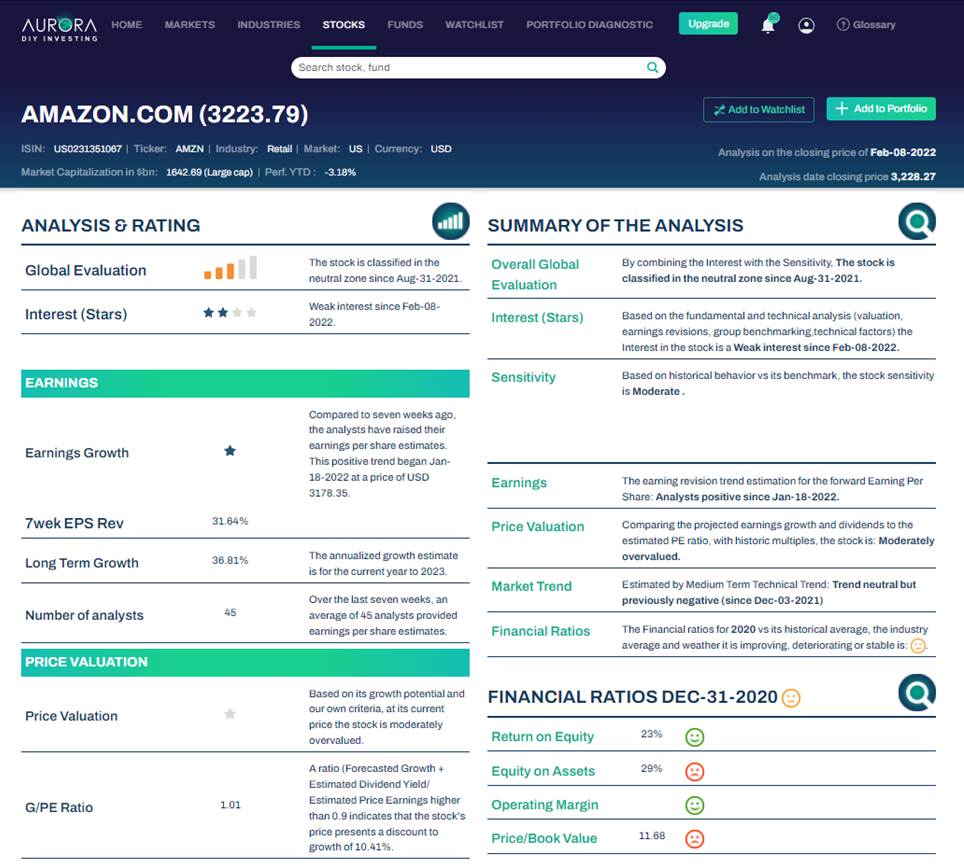

2. Identify your investments using our search tool, or by navigating our Funds and Stock screens. Click to add each investment to your newly created Portfolio.

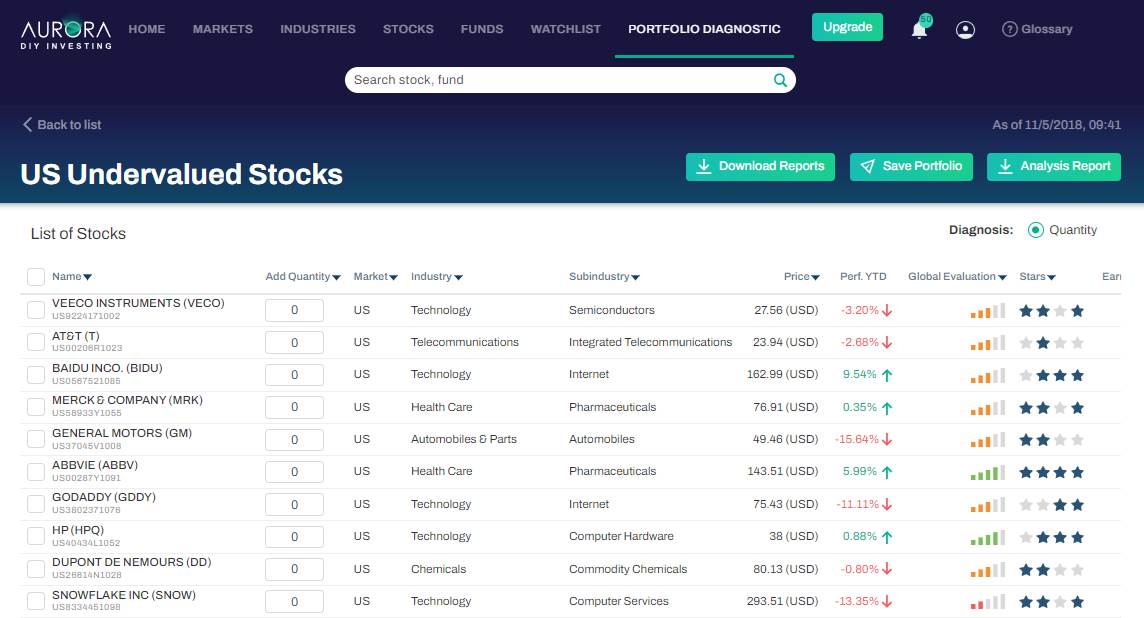

3. Once you have added all your holdings to the Portfolio, visit the Portfolio overview page and add the quantities of each you hold.

4. Click the “save and send to diagnostic” button. Wait for “the report is ready” alert then click on “Report” button to download your personalized portfolio Diagnostic report which includes the following elements:

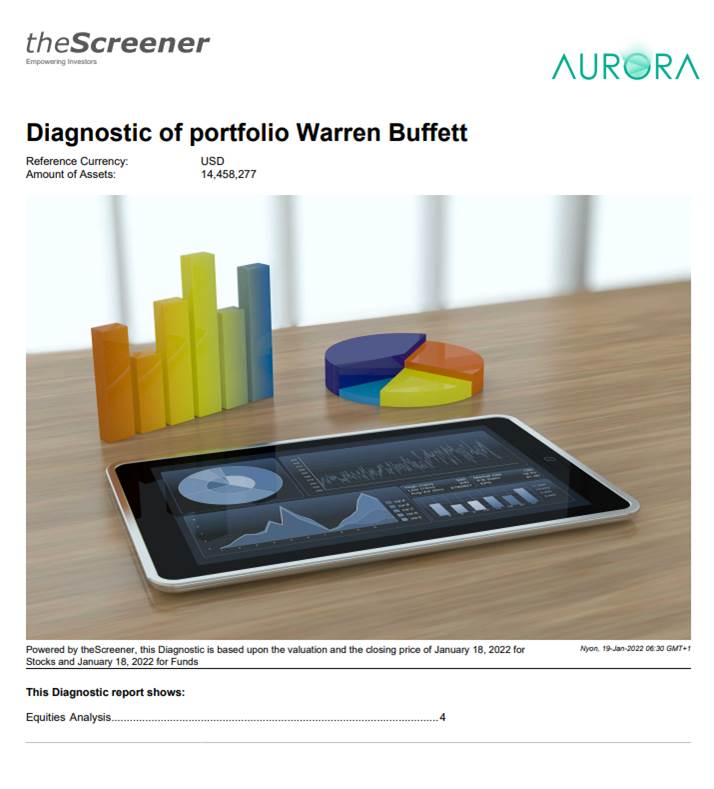

DIAGNOSE YOUR INVESTMENT PORTFOLIO

Up-to-date reporting on your portfolio performance

Funds and Equities

Analysis A breakdown of the composition of your portfolio providing a detailed analysis of your fund and equity positions identifying weaknesses with respect to valuations and alternatives that might be of interest.

At a Glance

A summary of your allocations by asset class and currency with a top level analysis of your funds and equity positions.

Equities Analysis

Outlines the performance of each equity component and identifies the specific in-stances where our evaluation has changed . This section also extends the analysis to include key metrics on interest and sensitivity criteria as well as weighting metrics on sector and regional allocations which can provide insights into possible diversifica-tion strategies.

Alternative Equities

Analysis Organised by investment strategy, this section offer detailed metrics on attractive equities that we assess may be realistic substitutions for portfolio assets that rate poorly at the time of the diagnostic.

Funds Analysis

In the same way we offer portfolio equities analysis, our funds analysis provides deep insights into the composition and performance of the various funds in your portfolio, outlining allocations by Asset Class and Currency and identifying which elements are performing well or poorly.

Alternative Funds Analysis

Based on our analysis of the funds in your portfolio, we provide suggestions for attractive funds that we assess may be realistic substitutions for those which rate poorly at the time of the diagnostic.

Glossary

A comprehensive reference to the language and terminology used in the report.

The system provides information and financial data to help you identify investment ideas. However, we do not advise or guide you in this regard, or provide recommendations on what products to buy or sell – these decisions are yours alone. SDIS and the system are not subject to regulation, and SDIS does not hold a license for investment advice, investment marketing or management of investment portfolios under any law.

The content provided in the system is independent and is not based on or tailored to your personal circumstances, needs or purposes, and should not be relied upon as an assessment of the profitability or suitability of investing in a particular stock for any purpose. Past performance is no guarantee of present or future performance. Investments can lose their full value.